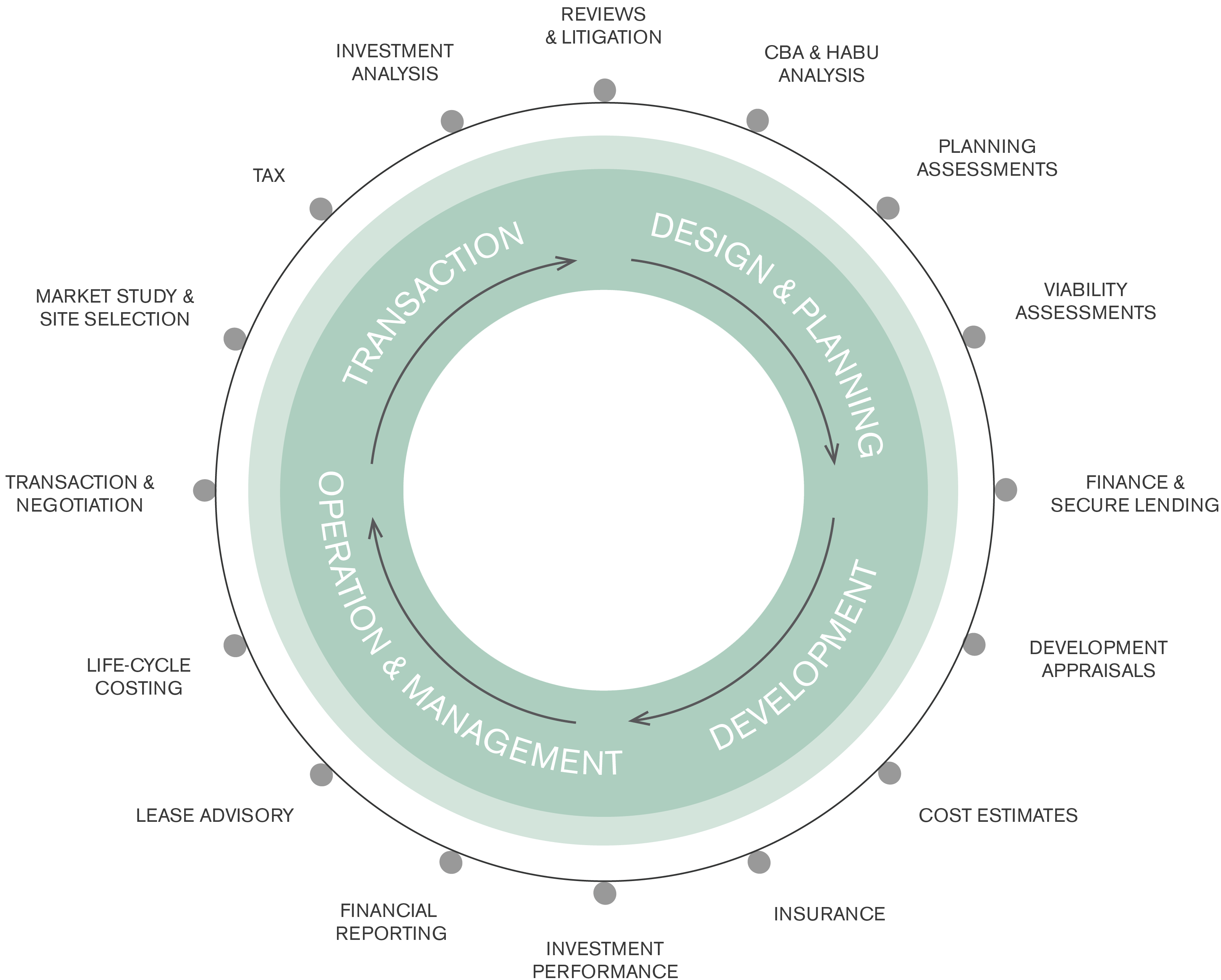

This team empowers our clients with comprehensive assistance throughout all phases of the real estate lifecycle.

We deliver clarity, forward-looking insights and intelligent advice through our diverse range of integrated services. Our expertise and portfolio spans three core divisions: valuation and investment advisory, cost management and consultancy, and sustainability and ESG services.

Our approach, thinking and success are based on our company values and the following core principles:

We maintain and develop essential knowledge and professional practice. This is done through the development of quality control and assurance policies, following professional standards and regulatory and legal requirements, life-long learning commitments and constantly practising.

Some of our notable clients who use our advisory and valuation services include:

We offer a full suite of valuation services which will enable you to get reliable, quality and accurate assessments from qualified valuers with expertise across all property types (residential, commercial, operational and development) and all valuation purposes.

Valuation types:

Purposes:

Property types:

Our work is analytical as well as descriptive, we answer the supplementary question to ‘what is the price?’ which is ‘is it worth that price?’ by helping our clients identify investments that meet their needs, perform feasibility assessments, monitor their performance and support them through all phases of the real estate lifecycle.

Our cost managers play a key role throughout the entire project lifecycle, offering a comprehensive range of services related to cost management and consultancy. In essence our system is designed to optimize this process from cost estimation, procurement and contract administration to quantity surveying, certification and rebuilding cost assessments (aka insurance valuations) in a clear and effective matter. By incorporating these strategies, we can enhance the accuracy of our cost analysis and surveying efforts, providing our employers with the peace of mind they seek.

We can assist you in due diligence and risk assessments which are an integral input to the real estate investing process, be it for acquisitions, division, mergers or lending opportunities. We helps clients perform these functions and avoid surprises with an in-depth grasp of the real estate industry, along with our specialized expertise in construction and planning areas.

Building for people, not just spaces:

Certifications in PassiveHouse, Fitwel, Well, BREEAM

At Archi+, we believe that sustainability and resiliency is more about changing attitude and culture than it is about satisfying requirements. Hence, sustainable thinking and good design is integrated into all phases of our projects and departments.

We help you find sustainable solutions which maximise asset value, mitigate risk, create new revenue streams, reduce occupancy costs or enhance wellbeing. Enabling you to transform the way you invest in, develop, manage or occupy buildings.